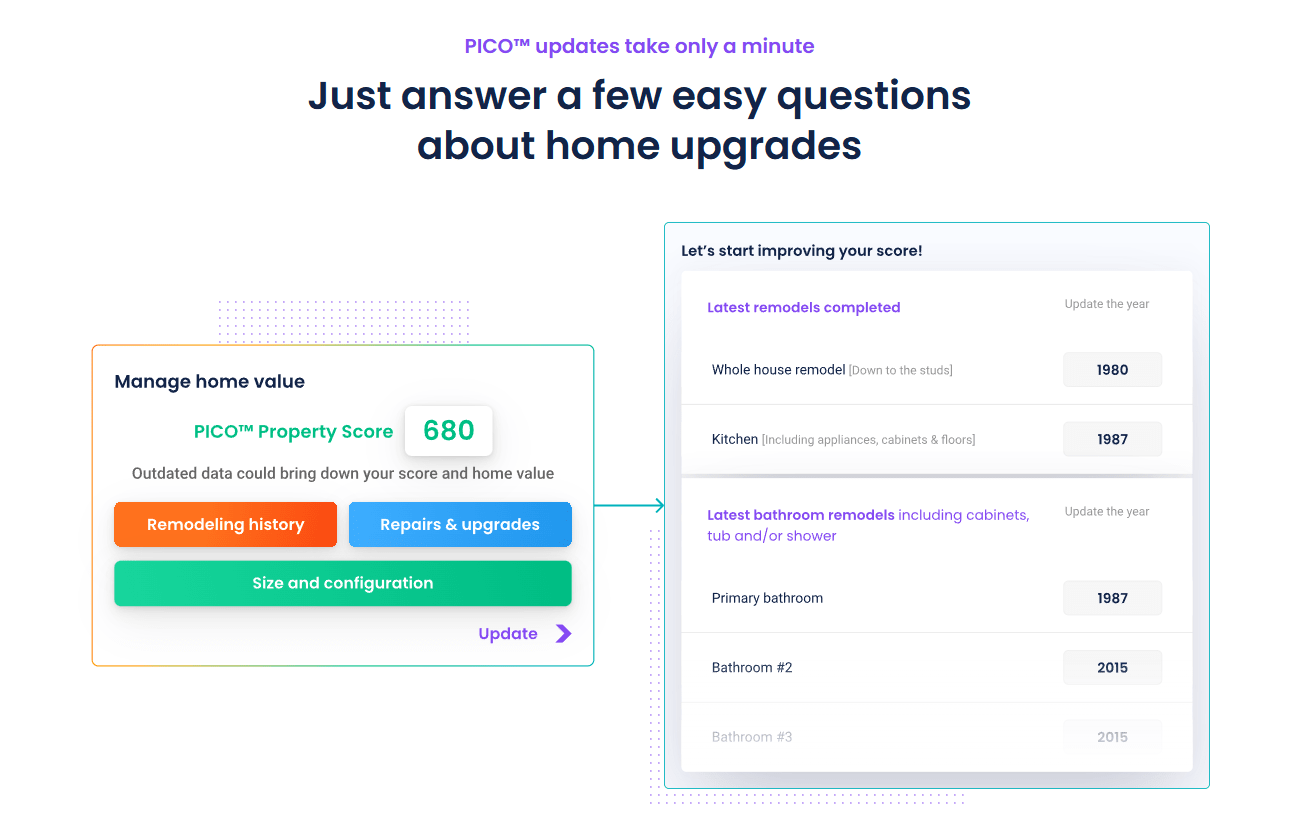

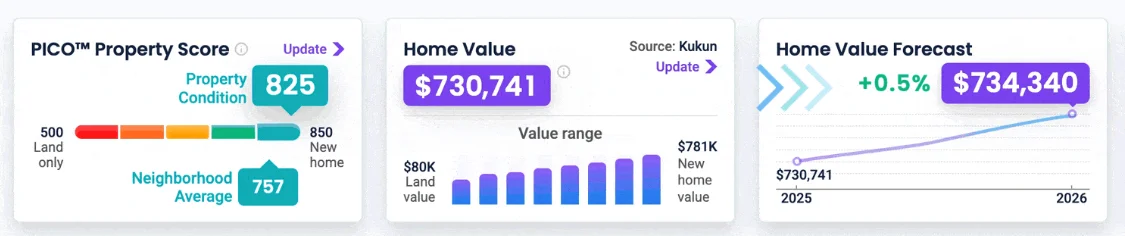

I led the development of PICO™, an innovative scoring system designed to quantify home condition in a way that’s as intuitive as a credit score. The tool helps homeowners, buyers, and financial institutions understand the impact of upkeep, renovations, and useful life cycles of different parts of a house on overall property value. By bridging property condition with real market value, PICO™ empowered both consumers and partners to make smarter decisions about investment, renovation, and resale opportunities.

My Role

Product Leadership: Directed the initiative to conceptualize and bring to market a property scoring system modeled after credit scoring.Data Integration: Collaborated with data science and valuation teams to incorporate property aging models and ROI metrics.

Platform Modernization: Defined architecture that allowed real-time recalculation of home value when property details or renovation inputs were updated.

Cross-Functional Enablement: Partnered with sales and marketing to position PICO™ as a unique differentiator for financial institutions and homeowners.

Core Features

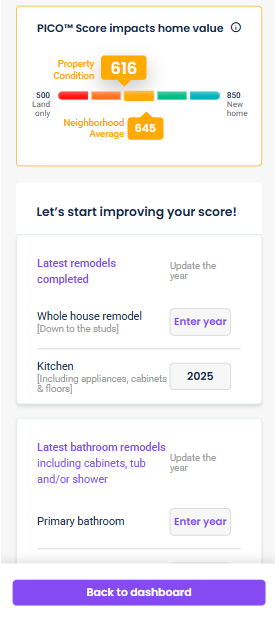

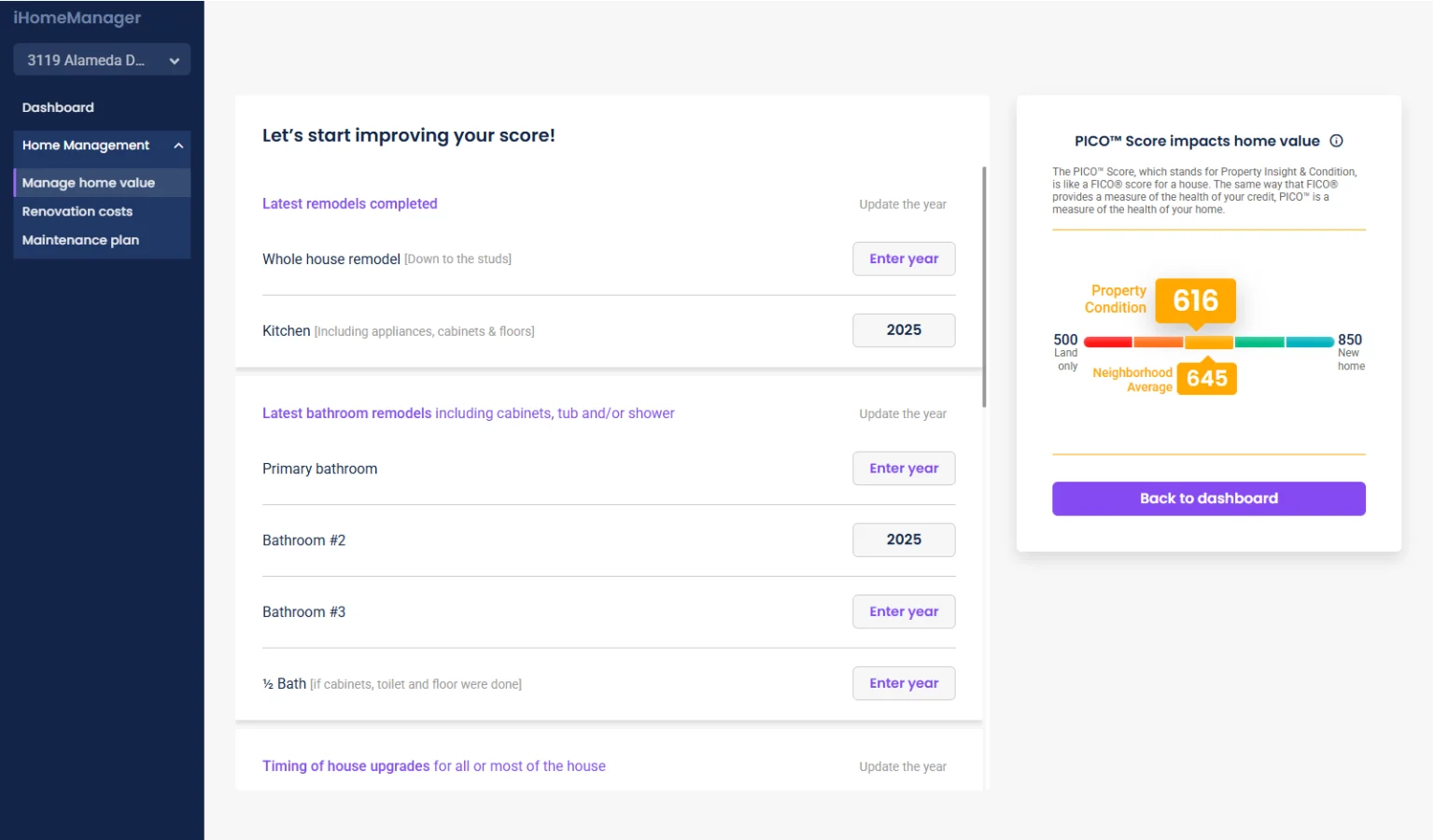

Intuitive Scoring: A scale from 500 to 850, making it easy for anyone to understand property condition at a glance.Current vs. Future Value: Shows today’s home value based on existing condition and the potential future value after renovations.

Useful Life Modeling: Integrates the lifespan of key home components (HVAC, kitchens, bathrooms, roofing, etc.) into value calculations.

Scenario Planning: Allows homeowners to test different renovation plans and instantly see projected ROI.

Seamless Updates: Simple interface for users to update property data such as square footage, condition, or recent upgrades.

Impact

Market Differentiation: Positioned the company as the first to provide a standardized, consumer-friendly property condition score.Consumer Empowerment: Helped homeowners understand how maintenance and renovations directly influence value.

Partner Adoption: Attracted major financial institutions by offering a transparent, data-driven model to assess property risk and potential.

Future-Proof Design: Created a scalable foundation to expand into broader property analytics and integrated mortgage/insurance use cases.